Which of the Following Is an Example of Tangible Property

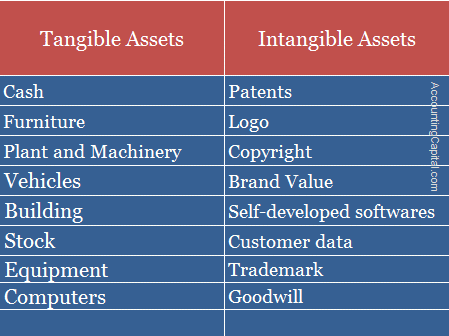

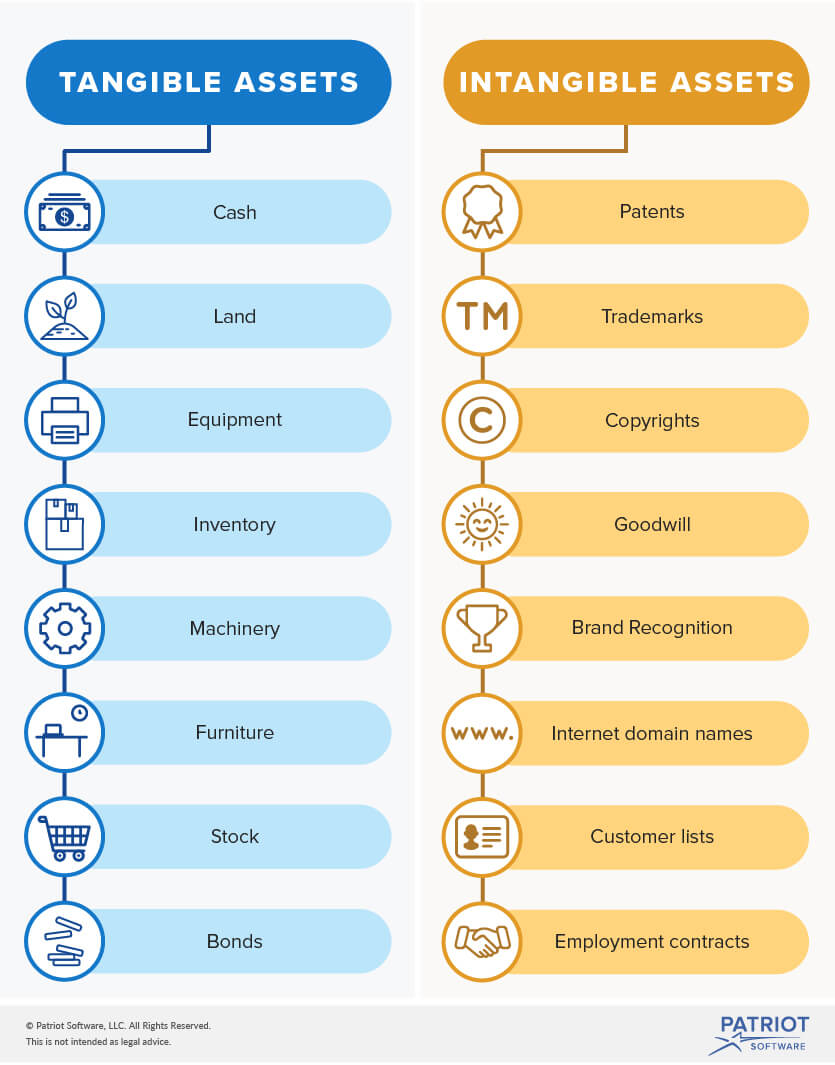

Assessments of Business tangible personal property taxes are based on percentage of original cost and the purchase year of the property. The TBV excludes a firms intellectual property patents and trademarks because these are intangible assets that cannot be easily sold such as property plant and equipment.

Difference Between Tangible And Intangible Assets With Examples

A material or supply as defined in 1162-3c1 that is acquired and used to improve a unit of tangible property is subject to this section and is not treated as a material or supply under 1162-3.

. There follows a treatment of possession and ownership categories that are closely related historically in the West. Property law must be followed for each liability and that states required dormancy period which determines when the liability becomes unclaimed property and subject to being reported and remitted. The business tangible personal property tax is levied on all general office furniture and equipment machinery and tools equipment used for research and development heavy construction equipment computer equipment and peripherals located in.

Where to report and remit unclaimed property is primarily determined based on the following Supreme Court decisions. Lets look at an example. A method for creating ice cream that you friend thought of An idea for an invention that your dad mentioned briefly but did not write down Song lyrics printed in a songbook A quicker system of washing a car that you thought of last summer Correct me.

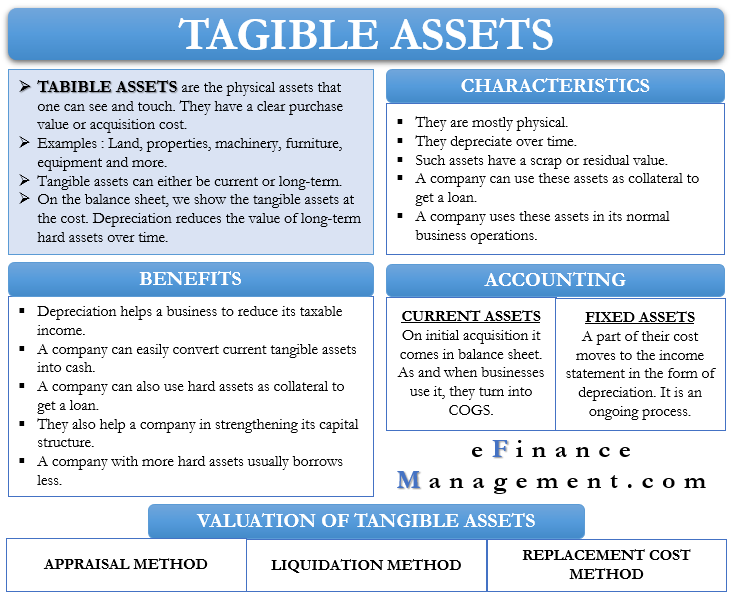

The tangible book value formula is calculated using the firms total assets total liabilities intangible assets and goodwill. The following example illustrates the rules of this paragraph c. Which of the following is an example of tangible property.

The assessment is then multiplied by the tax rate 00428 to calculate the tax due. For example property purchased last year first year will be assessed at 25 of the original purchase price. Property plant and equipment PPE are long-term tangible assets Tangible Assets Tangible assets are assets with significant value and are available in physical form.

Then the discussion deals with divisions of ownership and in so doing contrasts. The discussion of property hinges on identifying the objects things and subjects persons and groups of the jural relationships with regard to things in Western legal systems generally. It means any asset that can be touched and felt could be labeled a tangible one with a long-term valuation.

Read more that are physical in nature.

Tangible Vs Intangible Assets What S The Difference

Tangible Assets Learn How To Classify And Value Tangible Assets

No comments for "Which of the Following Is an Example of Tangible Property"

Post a Comment